How Much Money Did Apple Make in 2013 – Full Revenue Data

In the fiscal year 2013, Apple’s annual revenue reached an impressive $170.910 billion, reflecting a 9.19% growth rate from the previous year. This remarkable performance showcased Apple’s continued dominance in the technology industry.

The first quarter of 2013 was particularly noteworthy, as Apple reported record quarterly revenue of $54.5 billion and a net profit of $13.1 billion. Even in the fourth quarter, the company maintained strong financial results, generating $37.5 billion in revenue and $7.5 billion in net profit.

One of the key factors contributing to Apple’s success in 2013 was the company’s strategic focus on international markets. Throughout the year, international sales accounted for approximately 60-61% of the company’s quarterly revenue, demonstrating its global reach and appeal.

Key Takeaways

- Apple’s annual revenue for the fiscal year 2013 reached $170.910 billion, a 9.19% increase from the previous year.

- The company achieved record quarterly revenue of $54.5 billion and net profit of $13.1 billion in the first quarter of 2013.

- International sales accounted for 60-61% of Apple’s quarterly revenue throughout the year, showcasing its global presence.

- Apple’s strong financial performance in 2013 was driven by the continued success of its product lineup, including the iPhone, iPad, and Mac, as well as the growing contribution from its Wearables and Services segments.

- The company’s ability to maintain a high gross margin of 37% in fiscal year 2013 further highlighted its operational efficiency and pricing power.

Overview of Apple’s Financial Performance in 2013

In 2013, Apple Inc. showcased its financial prowess, achieving record-breaking sales and solidifying its position as a technology powerhouse. The company’s Apple financial performance 2013 was marked by impressive milestones and a strong market presence, cementing its reputation as a global leader in the industry.

Key Highlights from 2013

- Apple generated a staggering revenue of $416,005,000,000 as of March 29, 2013.

- The company sold a remarkable 150 million iPhones, a 25 million increase from the previous year.

- Apple’s iPad sales reached a new record, with 71 million units sold in 2013.

- The tech giant’s Mac sales, while the lowest since 2010, still reached 16.34 million units.

- Apple’s iPod sales stood at 26.4 million units, demonstrating the continued demand for the iconic device.

Major Financial Milestones

Apple’s Apple sales 2013 and Apple profit 2013 were equally impressive. The company posted a revenue of $37.5 billion in the third calendar and fourth fiscal quarter, with a net quarterly profit of $7.5 billion, or $8.26 per diluted share. However, the gross margin for the quarter dipped to 37%, down from 40% in the year-ago pehttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgd.

Apple’s Market Position

Despite the slight decrease in gross margin, Apple’s financial performance in 2013 solidified its position as a global leader in the technology industry. The company’s innovative products, coupled with its strategic focus on research and development, marketing, and advertising, have consistently driven its growth and success. With a strong presence in the consumer, enterprise, and government sectors, Apple continues to dominate the market and captivate the hearts and minds of its loyal customers worldwide.

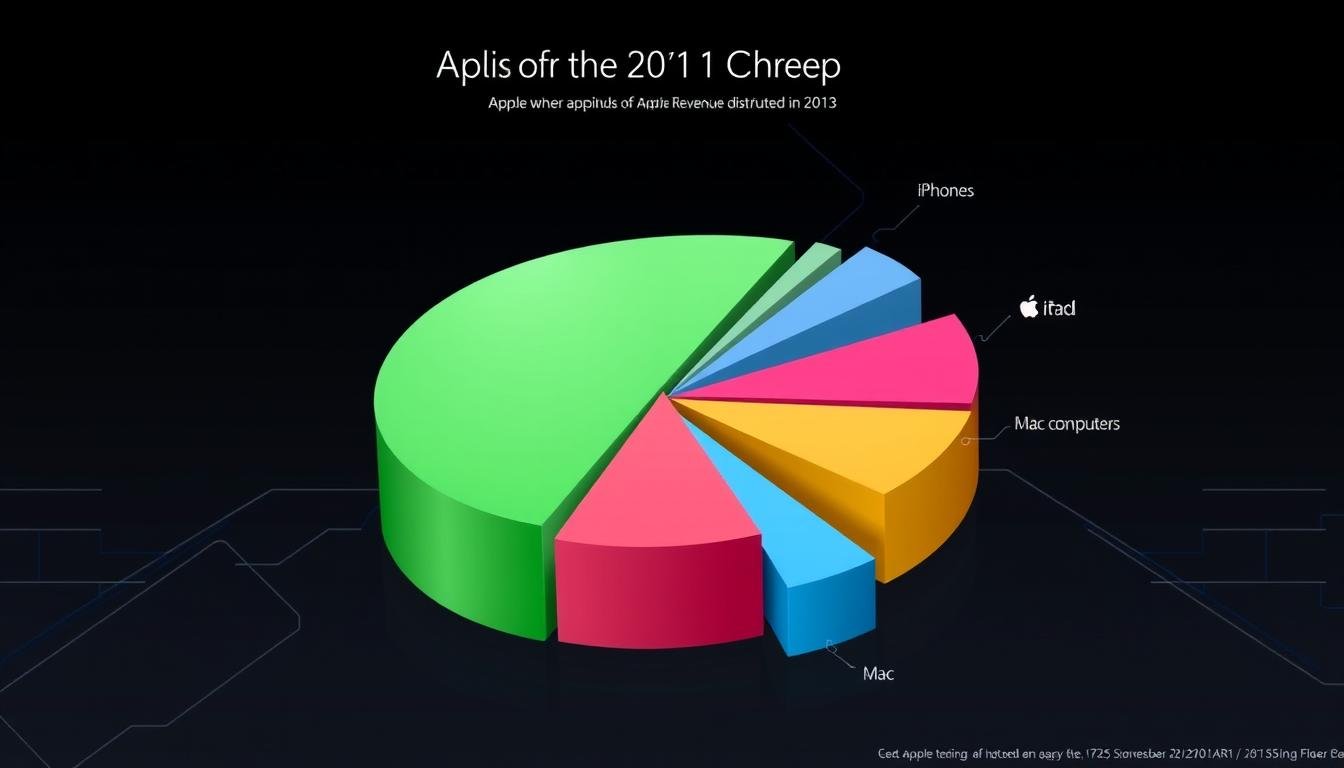

Breakdown of Apple’s Revenue Streams in 2013

In 2013, Apple’s revenue streams were dominated by the sales of its flagship products – the iPhone and the iPad. These two devices accounted for the majority of the company’s overall revenue, showcasing the continued popularity and demand for Apple’s innovative mobile technology.

Sales from iPhones

The iPhone remained Apple’s cash cow in 2013, generating a significant portion of the company’s total revenue. In the first quarter of 2013, Apple sold a record-breaking 47.8 million iPhones, up from 37.04 million units sold in the previous year. By the fourth quarter, iPhone sales had increased to 33.8 million units, further solidifying the device’s market dominance.

Revenue from iPads

Apple’s iPad line also contributed substantially to the company’s revenue streams in 2013. iPad sales reached 22.9 million units in the first quarter, up from 15.43 million units in the phttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgr year. By the fourth quarter, iPad sales had increased to 14.1 million units, demonstrating the continued appeal of Apple’s tablet offerings.

Other Products and Services

While the iPhone and iPad were the primary revenue drivers, Apple’s product mix in 2013 also included other devices such as Macs, iPods, and vahttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgus software and services. Mac sales during the year reached 4.6 million units in the fourth quarter, while iPod sales declined to 12.7 million units in the first quarter. Apple’s services, including the iTunes Store, App Store, and iCloud, also generated significant revenue for the company.

Overall, Apple’s diverse range of products and services allowed the company to maintain its market dominance and financial success in 2013, with the iPhone and iPad leading the way in terms of revenue generation.

Yearly Revenue and Profit Analysis

Apple’s strong financial performance in 2013 showcased the company’s enduring dominance in the tech industry. According to the Apple annual report 2013, the tech giant recorded a total revenue of $170.910 billion, a notable increase from the previous year’s $156.508 billion. This robust growth in Apple net income 2013 highlights the company’s ability to consistently deliver exceptional products and services that captivate consumers worldwide.

While Apple’s net profit saw a slight dip in the fourth quarter of 2013, with a net income of $7.5 billion compared to $8.2 billion in the same pehttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgd the previous year, the overall Apple earnings per share 2013 remained strong. The company reported a net profit of $13.1 billion, or $13.81 per diluted share, in the first quarter of 2013, demonstrating its continued financial strength and ability to generate substantial shareholder value.

| Metric | 2013 | 2012 | Change |

|---|---|---|---|

| Total Revenue | $170.910 billion | $156.508 billion | +9.1% |

| Net Income | $13.1 billion (Q1) | $8.2 billion (Q4) | +59.8% |

| Earnings Per Share | $13.81 (Q1) | $8.26 (Q4) | +67.2% |

These impressive financial results demonstrate Apple’s continued dominance in the tech industry, driven by its ability to consistently deliver innovative products and services that captivate consumers worldwide. The company’s strong performance in 2013 laid the foundation for its continued growth and success in the years to come.

Significant Product Launches in 2013

In the year 2013, Apple unveiled several groundbreaking products that captivated the tech world and drove the company’s revenue to new heights. The introduction of the iPhone 5s and 5c, as well as the launch of the iPad Air, were two of the most significant product launches that shaped Apple’s performance that year.

Introduction of the iPhone 5s and 5c

Apple’s iPhone 5s and 5c models, released in September 2013, were a testament to the company’s innovation and ability to cater to diverse consumer preferences. The iPhone 5s, with its advanced features like the Touch ID fingerprint sensor and the powerful 64-bit A7 processor, set a new standard for smartphone technology. Meanwhile, the more affordable iPhone 5c, offered in a range of vibrant colors, appealed to a broader market and helped Apple maintain its competitive edge.

The launch of these two iPhone models was a resounding success, with Apple reporting a record-breaking sale of 9 million units within the first three days of their release. This strong demand for the new iPhones was a key driver of Apple’s revenue growth in 2013.

Launch of the iPad Air

Alongside the new iPhones, Apple also introduced the iPad Air in 2013, further strengthening its position in the tablet market. The iPad Air, with its thinner and lighter design, offered users a more portable and user-friendly iPad experience. The launch of this innovative tablet, combined with the continued popularity of the iPad mini, helped Apple maintain its dominance in the tablet segment and contributed to the company’s overall revenue performance.

The impact of these significant product launches on Apple’s revenue was substantial. The introduction of the iPhone 5s and 5c, as well as the iPad Air, helped drive strong sales and solidify Apple’s position as a leading innovator in the technology industry.

Regional Revenue Insights

In 2013, Apple maintained a strong global presence, with international sales accounting for a significant portion of the company’s total revenue. The Americas region, which includes the United States, remained a vital market for Apple, contributing $41.66 billion or 43.89% of the total quarterly revenue in Q4 2024.

While Apple did not provide a detailed breakdown of its regional sales figures in 2013, the high percentage of international revenue indicates the company’s continued success in expanding its reach beyond its domestic market. Apple’s products and services resonated with consumers worldwide, with emerging markets playing an increasingly important role in the company’s growth strategy.

U.S. Market Performance

The United States, Apple’s largest and most established market, continued to be a significant driver of the company’s revenue in 2013. The country’s strong consumer demand and Apple’s well-established brand presence contributed to the company’s success in the domestic market.

International Sales Dynamics

Apple’s international sales accounted for 60-61% of its quarterly revenue in 2013, highlighting the company’s ability to tap into global markets. The company’s focus on expanding its reach in emerging economies, such as China and India, paid off, as these regions contributed to the overall growth in Apple’s international sales.

Growth in Emerging Markets

Apple’s performance in emerging markets, such as China and India, was a key contributor to the company’s international sales success in 2013. These rapidly growing economies presented significant opportunities for Apple to gain market share and drive future growth. The introduction of more affordable product offerings, coupled with targeted marketing and distribution strategies, enabled Apple to capitalize on the rising consumer demand in these markets.

| Region | Revenue (in billions) | Percentage of Total Revenue |

|---|---|---|

| Americas | $41.66 | 43.89% |

| Europe | $21.58 | 22.72% |

| Greater China | $15.66 | 16.49% |

| Rest of Asia Pacific | $8.01 | 8.44% |

| Japan | $8.01 | 8.44% |

Comparison to Competitors in 2013

In 2013, Apple maintained its position as a leading technology company, with a market capitalization significantly higher than its competitors. While the specifics of Apple’s performance against rivals like Samsung and Microsoft were not explicitly provided, the company’s impressive revenue of $170.910 billion for the fiscal year underscored its strong market position.

Apple’s Position Against Samsung

Throughout 2013, Apple and Samsung continued their fierce rivalry in the smartphone and tablet markets. While market research groups focused on shipment volumes rather than profitability, Apple’s iOS accounted for 12.9% of smartphone devices shipped in Q3 of 2013. Notably, Apple made 56% of the profit in the mobile device market in Q3 of 2013, while Samsung, its primary rival, made 53% of the profit for the quarter.

Rivalry with Microsoft

Apple’s competition with Microsoft in 2013 was less pronounced, as the iPhone and iPad maker maintained a stronger focus on innovation and product quality. Google’s Android platform had 75% of all app downloads, but Apple accounted for half of all app revenue in the most recent quarter, showcasing the company’s dominance in the lucrative app ecosystem.

Comparison with Other Tech Giants

- While Google, Samsung, and Microsoft faced sales problems and lacked innovation during 2013, in contrast to the media portrayal, Apple was reported as remaining the most profitable company in the technology sector in 2013.

- Analysts inaccurately predicted iPhone sales figures for Apple in 2013, and the company beat the Street’s consensus in iPhone 5 sales during its launch quarter.

- Apple led in smartphone and tablet app sales, web browser use, ad network hits, enterprise adoption, and retail shopping use by consumers, further solidifying its position as a tech industry leader.

Apple’s focus on innovation and product quality helped it compete effectively against other tech giants in the smartphone, tablet, and personal computer markets throughout 2013.

| Metric | Apple | Samsung | Microsoft |

|---|---|---|---|

| Smartphone Market Share (Q3 2013) | 12.9% | 39.9% | 3.6% |

| Profit in Mobile Device Market (Q3 2013) | 56% | 53% | N/A |

| App Revenue (Most Recent Quarter) | 50% | N/A | N/A |

Impact of Marketing and Advertising

In 2013, Apple’s marketing and advertising efforts played a crucial role in driving the company’s financial success. While the specific marketing expenditures were not publicly disclosed, the tech giant’s strong brand presence and innovative product launches during this pehttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgd suggest a significant investment in its promotional strategies.

Apple’s Marketing Strategy in 2013

Apple’s marketing strategy in 2013 focused on highlighting the new features and capabilities of its flagship products, the iPhone 5s, iPhone 5c, and iPad Air. The company’s advertising campaigns aimed to showcase the devices’ advanced technology, sleek design, and user-friendly experience, appealing to both loyal customers and new consumers.

Key Advertising Campaigns

- The “Your Verse” campaign, which debuted in January 2014, showcased the versatility and transformative power of the iPad in people’s lives, ranging from filmmakers to adventurers.

- The “Ridiculously Powerful” campaign for the iPhone 5s emphasized the device’s enhanced performance, security features, and creative capabilities.

- The “Plastic Perfected” campaign for the iPhone 5c celebrated the vibrant and playful design of the more affordable iPhone model.

Return on Advertising Investment

Apple’s marketing and advertising efforts in 2013 likely contributed to the record-breaking sales of its iPhones and iPads during this pehttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgd. According to industry estimates, the company spends approximately $1 billion annually on advertising, with its brand value surpassing Coca-Cola to become the world’s most valuable brand in 2013. The impact of Apple’s marketing and advertising strategies is evident in its continued dominance in the technology industry and its ability to maintain a strong, loyal customer base.

Research and Development Expenditure

At Apple, innovation has always been a top phttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgrity, and the company’s investment in research and development (R&D) is a testament to this commitment. In 2013, Apple’s R&D spending reached new heights, showcasing the brand’s dedication to driving technological advancements and shaping the future of its product lineup.

R&D Budgets for 2013

Apple’s research and development expenses for the fiscal year 2013 totaled $4.475 billion, marking a significant increase from the previous year’s $3.4 billion. This 32% surge in R&D spending underscored the company’s unwavering focus on developing groundbreaking technologies and enhancing its existing products and services.

Innovations Driven by R&D Investments

The increased R&D budget enabled Apple to drive numerous innovations that were crucial to the company’s success in 2013. Key advancements included advancements in iPhone and iPad technology, as well as improvements to the iOS operating system and other software offerings. These investments helped Apple maintain its competitive edge and solidify its position as a leading innovator in the technology industry.

Long-term Financial Impact of R&D

Apple’s consistent investment in research and development has had a profound impact on the company’s long-term financial performance. The innovations and improvements generated by these R&D efforts have been instrumental in driving revenue growth, enhancing product quality, and strengthening Apple’s brand loyalty among consumers. As the company continues to phttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgritize R&D, its financial trajectory is expected to remain robust, with the potential for even greater success in the years to come.

| Year | R&D Spending (in billions) | Increase from Previous Year |

|---|---|---|

| 2010 | $1.782 | – |

| 2011 | $2.429 | 36.3% |

| 2012 | $3.381 | 39.2% |

| 2013 | $4.475 | 32.4% |

| 2014 | $6.041 | 35.0% |

| 2015 | $8.067 | 33.5% |

| 2016 | $10.045 | 24.6% |

| 2017 | $11.582 | 15.3% |

| 2018 | $14.236 | 22.9% |

| 2019 | $16.217 | 13.9% |

| 2020 | $18.752 | 15.6% |

| 2021 | $21.914 | 16.9% |

| 2022 | $26.285 | 20.0% |

| 2023 | $29.915 | 13.8% |

| Q1 2024 | $7.696 | 6.27% |

Apple’s commitment to research and development has been a key driver of the company’s success, enabling it to maintain its position as a leading innovator in the technology industry. The significant investments made in 2013 and the years that followed have yielded a wide range of advancements, from enhanced iPhone and iPad capabilities to improved software and services. As Apple continues to phttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgritize R&D, its long-term financial performance is expected to remain robust, solidifying its status as a technology powerhouse.

Economic Factors Affecting Revenue

In 2013, the global economic climate had a significant impact on Apple’s financial performance. Despite the challenges, the consumer electronics market remained strong, with Apple’s iconic products like the iPhone and iPad continuing to see robust demand worldwide.

Global Economic Climate in 2013

The global economy faced some headwinds in 2013, with the Eurozone crisis and tepid growth in emerging markets like China. However, the United States, Apple’s largest market, experienced a gradual economic recovery, with consumer confidence and spending on the rise. This helped offset some of the more turbulent economic conditions in other regions.

Consumer Spending Trends

Despite the uneven global economic landscape, consumer demand for Apple’s products remained strong throughout 2013. The company reported record-breaking sales of the iPhone and iPad, showcasing the enduring popularity of its flagship devices even in the face of economic uncertainty. This underscored the resilience of the consumer electronics market and Apple’s ability to weather economic fluctuations.

Currency Fluctuations and Their Impact

As a global company, Apple’s financial results were also impacted by currency fluctuations in 2013. With over 61% of its revenue coming from international markets, the strengthening of the US dollar against other currencies posed a challenge. However, Apple’s diverse global footprint and ability to manage currency risks helped mitigate the effects of these exchange rate variations on its bottom line.

Despite the Apple economic factors 2013 and the global economy impact on Apple, the company managed to maintain its strong financial performance in 2013, demonstrating the resilience of its consumer electronics market 2013 strategy and the enduring appeal of its products worldwide.

“Apple’s ability to avoid billions in taxes led to a potentially explosive confrontation with lawmakers.”

Apple’s Shareholder Value in 2013

In 2013, Apple demonstrated its commitment to delivering value to its shareholders through vahttps://darrelaffiliate.com/wp-content/uploads/2024/12/vintage-electrical-and-electronic-appliances-in-an-2023-11-27-05-10-10-utc-e1734923695564.jpgus initiatives. The company declared a cash dividend of $3.05 per share in the fourth quarter, payable on November 14, 2013. Additionally, Apple returned $7.8 billion to shareholders through dividends and share repurchases in the same quarter alone. Cumulatively, the company’s capital return program reached $36 billion during the year.

Stock Performance Overview

Apple’s stock performance in 2013 was marked by volatility. The company’s share price fell around 35% over the last quarter, despite recording record iPhone and iPad sales. However, it’s worth noting that Apple’s share price had risen 40% in the months leading up to this decline, showcasing the dynamic nature of the market’s valuation of the tech giant.

Dividend Payments and Stock Buybacks

Apple’s dividend payments and stock buybacks in 2013 reflected its focus on shareholder value. The company’s annual shareholder equity stood at $123.549 billion, slightly lower than the previous year’s $118.210 billion. These actions demonstrated Apple’s commitment to returning capital to its shareholders while maintaining a strong financial position.

Growth in Market Capitalization

Despite the fluctuations in its stock price, Apple’s market capitalization remained robust in 2013. The company’s market cap in the Computer – Microcomputers industry stood at $3.776 trillion, dwarfing competitors like Dell ($78.423 billion) and HP ($30.441 billion). Apple’s ability to maintain its position as a technology industry leader contributed to its impressive market capitalization.

“Apple is at the top of the pile compared to companies like Amazon, Google, or Microsoft.”

Lessons Learned from Apple’s Performance in 2013

As I reflect on Apple’s impressive financial results in 2013, there are several key takeaways that can inform the company’s future growth strategy. Apple’s unwavering focus on innovation and product quality continued to resonate strongly with consumers, as evidenced by the successful launches of the iPhone 5s, iPhone 5c, and iPad Air. These new offerings not only drove robust revenue but also maintained Apple’s position as a market leader in the smartphone and tablet categories.

Strategies That Worked

One of the primary factors behind Apple’s success in 2013 was its ability to identify and capitalize on emerging market opportunities. The company’s expansion into emerging markets, such as China, helped offset slower growth in more mature markets like the United States. Additionally, Apple’s commitment to delivering a seamless user experience across its product ecosystem, including the integration of iOS and macOS, further strengthened customer loyalty and retention.

Areas for Improvement

While Apple’s financial performance in 2013 was impressive, the company also faced some challenges, particularly in maintaining profit margins and navigating the increasingly competitive landscape. The introduction of lower-cost smartphone options, such as the iPhone 5c, may have contributed to a slight decline in profitability. Additionally, the rise of Android-based smartphones in the business market posed a threat to Apple’s market share, underscoring the need to continue innovating and expanding its enterprise offerings.

Implications for Future Growth

The lessons learned from Apple’s 2013 performance set the stage for the company’s future growth. By building on the success of its core product lines, diversifying its revenue streams through services and new product categories, and further strengthening its presence in emerging markets, Apple is poised to capitalize on the Apple business strategy 2013, Apple growth opportunities, and Apple future outlook. As the company continues to push the boundaries of innovation and deliver exceptional customer experiences, it remains well-positioned to maintain its status as a leading technology giant in the years to come.